Discuss your challenges with our solutions experts

In recent days, the Trump administration has declined the opportunity to use executive powers to directly support the coal industry.

The administration issued a statement on August 22 rejecting the request of some coal producers to place a two-year moratorium on coal plant retirements. On August 24, the Department of Energy released their "Staff Report on Electricity Markets and Reliability," which some thought would provide a strong endorsement of the value of baseload coal. This was not the case.

Several coal executives have requested that President Trump issue an emergency order postponing coal plant retirements for two years. Robert Murray, the CEO of Murray Energy Corporation, has been vocal, claiming that his company could go bankrupt without the order. Peabody Energy has also been outspoken on the need for a moratorium.

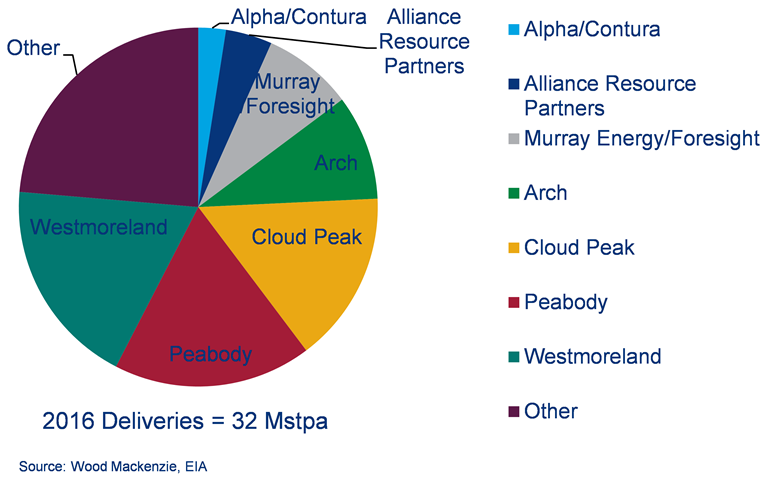

Retiring units consumed 32 Mst of coal in 2016

In 2016, Murray Energy provided nearly 2 million short tons to coal units that have announced retirement dates in the next two years, while Peabody sold nearly 6 Mst.

In addition, Mr. Murray's coal companies supplied nearly 5 Mst in 2016 to coal units belonging to the struggling FirstEnergy Solutions, which is in talks with creditors after both the state of Ohio and the federal government declined to subsidize its coal and nuclear units.

Excluding FirstEnergy's coal units, the near-term retiring coal units consumed 32 Mst of coal in 2016.

Are these coal units competitive?

Most of these units are not competitive in today's electricity market. That they operate to the extent they do is related to situational requirements — possibly including the need to honor take-or-pay coal contracts.

The owners of these near-term retirement units have considered the reliability consequences of retirement and are satisfied. Contrary to what seems like a way to prop up coal demand, our analysis indicates that the effect on total coal burn — should those coal units not retire — is minimal. It would essentially push other coal units to lower capacity factors, and the amount of coal-fired power generation would barely change.

Coal and the value of reliability and resilience

The administration also passed on another potential opportunity to make a stronger case for coal with the release of the Department of Energy's analysis of grid reliability.

The DOE's report was promoted by the coal and nuclear industries based on the theory that baseload plants, particularly coal and nuclear, are disadvantaged in the marketplace by renewable subsidies and a market structure that doesn't reward reliability — the ability to meet electricity demand — and resilience — the ability to survive or recover from extraordinary events.

The coal industry was hoping that the report would, perhaps, make recommendations for supporting coal plants. Instead, the report recognized that reliability and resilience are valuable and required, but it did not specifically endorse coal units other than to mention that coal units rank high in both reliability and resilience.

The report recommends that grid operators and vertical utilities work to properly value reliability and resilience while employing a fuel- and technology-neutral approach to near- and long-term planning.

President Trump and his administration are vocal supporters of the coal industry. However, the administration has decided that the security and reliability of the national electric system is not in jeopardy over the next two years to the extent that emergency executive powers must be used to "save" the grid, however painful the situation may be for some coal producers and coal unit operators.