A tale of two cities: comparing the Houston and Corpus Christi crude hubs

After decades with Houston at the heart of the US Gulf Coast crude value chain, shifting legislation and trade flows have brought about change. Will advanced economics mean Corpus Christi now dominates export growth?

4 minute read

Dylan White

Principal Analyst, North American Crude Markets

Dylan White

Principal Analyst, North American Crude Markets

Dylan leverages cutting-edge data to offer real-time insight into the oil industry.

Latest articles by Dylan

-

Opinion

TMX: first insights

-

Opinion

New York Harbor gasoline and ULSD inventories guide markets through a relatively tight 2023

-

Opinion

A tale of two cities: comparing the Houston and Corpus Christi crude hubs

-

Opinion

Keystone disruption comes at a key time for Western Canadian crude markets

-

Editorial

Breaking the Permian bottleneck: overcoming and overcorrecting

-

Opinion

Fairway’s caverns, other projects to expand US Gulf Coast crude storage capacity

John Coleman

Principal Analyst, North American Crude Markets

John Coleman

Principal Analyst, North American Crude Markets

John leads our North American Crude Markets Service, delivering regular market outlooks and analysis

Latest articles by John

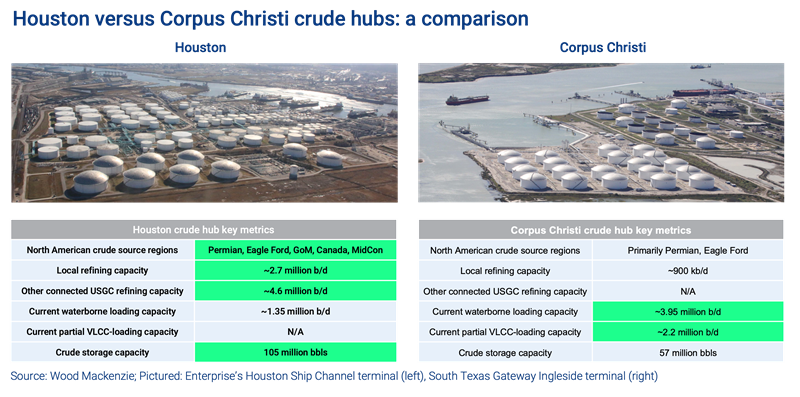

View John Coleman's full profileHouston has long been the epicentre of the US Gulf Coast (USGC) crude value chain. The legacy hub has vast connections to key crude supply regions, a sizeable share of the USGC refining complex and considerable waterborne dock capacity.

After decades serving as the undisputed crude capital of Petroleum Administration for Defense District (PADD) III, however, shifting legislation and trade flows have sparked change. Since the US ban on crude exports was lifted in late 2015, waterborne export loadings have boomed across the USGC. And while Houston terminals have certainly played their part in the export surge, it is Corpus Christi that has claimed the lion’s share of the growth.

In recent years Corpus Christi, 345 km down the Gulf coast, has emerged as the predominant window to the global market for US crudes. It has attracted substantial midstream investment to open export markets to booming Permian supply. Rapid, large-scale infrastructure development in the form of better dock capacity, inbound pipe capacity from the Permian and storage capacity has catapulted Corpus Christi into prime position for tidewater access for US barrels.

These days, Corpus Christi’s advantaged export economics attract record crude shipments from the Permian. And although Permian producers have shown investment restraint in recent years, the basin remains the crown jewel of the Lower 48 growth story.

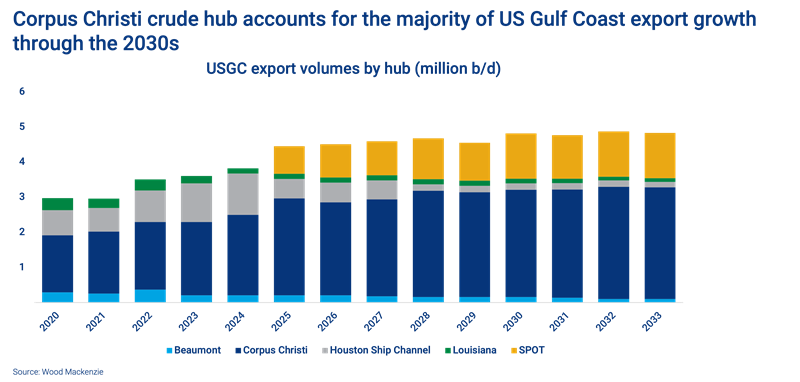

Growing Permian production in the coming years will translate directly into continued export growth from the USGC. The key question we are most often asked is: how will both hubs evolve in the decade to come with around 1.5 million b/d of export growth projected from 2022 levels into the 2030s?

Drawing on insights from our North America Crude Markets Service, we assessed our various forecasts to shed light on how the roles of Houston and Corpus Christi will develop as new norms and roles are cemented. Fill in the form to read A tale of two cities: assessing the comparative advantages of Houston and Corpus Christi crude hubs. And read on for a brief introduction.

Permian Basin growth to persist for now

The Permian Basin’s momentum is expected to continue through the middle of the decade, with about 2 million b/d of supply growth likely between 2021 and 2025. Growth is expected to slow eventually as core inventory exhaustion takes hold, resulting in a more plateauing profile into the 2030s.

This trajectory contrasts with a levelling out of US refining for the better part of a decade, followed by moderate declines in the 2030s (due to PADD III asset closures and conversions).

This juxtaposition paints a highly constructive picture for US export volumes in the decade to come. Our forecast sees waterborne volumes peaking at more than 4.8 million b/d by the early 2030s, up from 3.5 million b/d in 2022. Once near-term market frictions associated with filling new-build, long-haul capacity play out, we expect market forces to balance overall corridor utilisation between Permian-to-Houston and Permian-to-Corpus Christi This will raise key questions around Houston and Corpus Christi’s comparative advantages as the theme unfolds.

Our outlook sees midstream investments (both pipeline and dock capacity) over the next five years largely resolving any emerging constraints. We see an additional 800 kb/d or so of long-haul capacity from the Permian basin being called upon by 2028 ‒ all to Corpus Christi, driving further export growth there.

We assume Enterprise’s sea port oil terminal (SPOT) will be the only proposed offshore export terminal to reach commercial operation, going into service in 2025. SPOT will largely cannibalise Houston-area loadings away from Houston Ship Channel terminals and alleviate regional waterborne loading.

Houston to dominate USGC distribution, Corpus Christi to rule exports

We see Houston solidifying its role as the distribution focal point of the USGC. Refineries in Houston and the Eastern Gulf Coast will remain the primary consumption markets for domestic barrels entering Houston. Exports will persist from Houston ‒ supported, in particular, by very large crude carrier (VLCC) loadings from SPOT ‒ but claim a far lower market share of Houston-bound barrels than USGC refinery consumption.

Unparalleled connectivity to various production regions and downstream markets makes Houston an irreplaceable crossroads that will support refinery supply, both at home and abroad, for decades to come.

Meanwhile, we see Corpus Christi expanding its role as the premier USGC export hub. Limited local refining capacity and minimal connectivity to the rest of the USGC make waterborne loadings the dominant outlet for Corpus Christi-bound barrels. Advantaged export economics allow Corpus Christi to achieve the largest export volume growth of any USGC hub over the next decade, supported by Permian supply growth, midstream investments and abundant dock capacity.

Read A tale of two cities: assessing the comparative advantages of Houston and Corpus Christi crude hubs in full.

This includes charts on:

- Permian outbound pipeline utilisation by region

- Waterborne loadings and exports

- Permian oil production and growth forecast

- US refinery crude run changes

- And more

Fill in the form at the top of the page for your complimentary copy.